These proposals, along with ranks, are sent to the Capital Expenditure Planning Committee (CEPC) for consideration. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more.

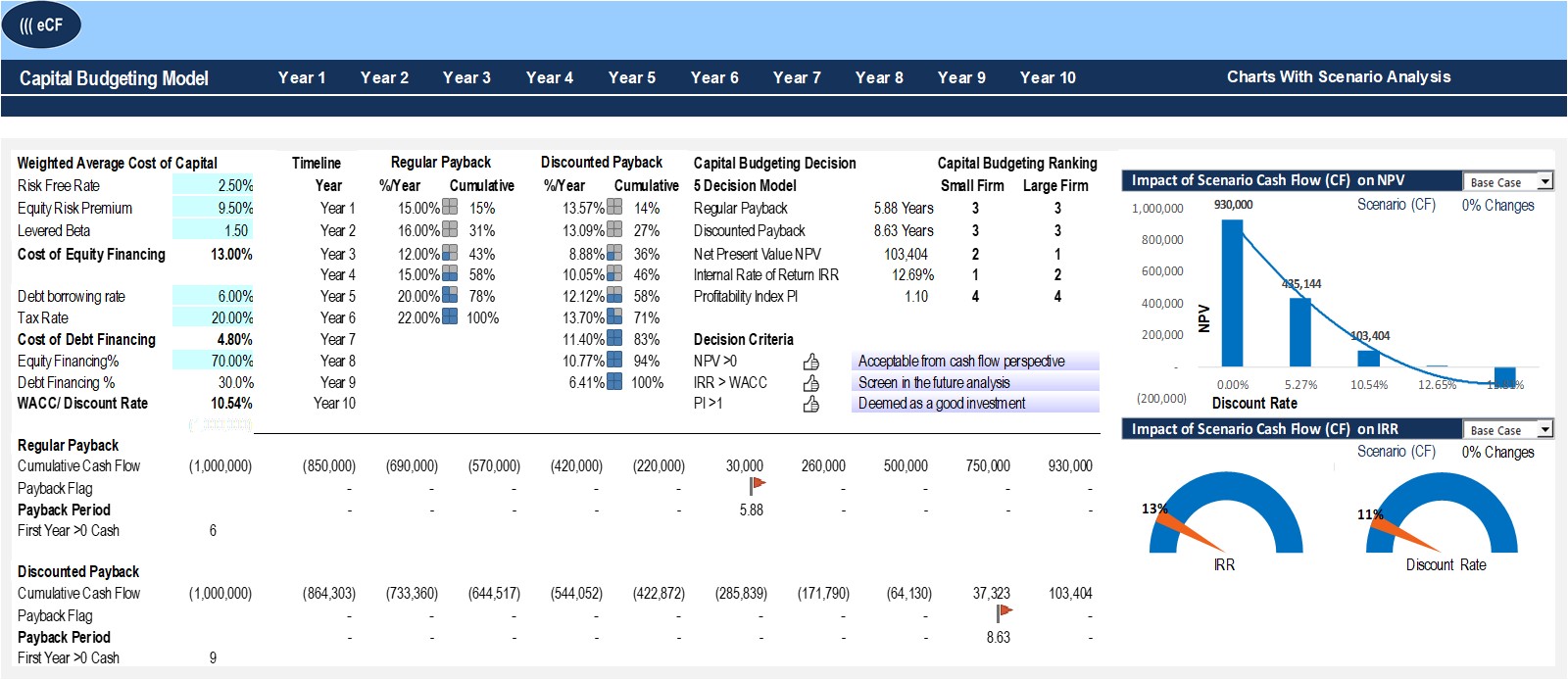

Payback Period

It is also referred to as the discounted flow rate of return or the economic rate of return. One of the primary challenges in capital budgeting for companies revolves around effectively allocating available funds to the most worthwhile projects. This challenge underscores the importance of employing quantitative evaluation methods and criteria to objectively rank projects and make well-informed accept or reject decisions. The discount factors provided in the tables cover two types of present value calculations, lump sum and annuity. Most organizations have limited resources and more potential capital projects than they can fund.

What Are Common Types of Budgets?

She estimates that she can provide 40 rides per week and work 50 weeks per year. The discount factor for an immediate cash inflow or outflow is 1 since the time value of an amount today is 100%. Column A is for the year or years in which the cash inflow or outflow occurs.

Create a Free Account and Ask Any Financial Question

- Another major advantage of using the payback period is that it is easy to calculate once the cash flow forecasts have been established.

- A company may use experience or industry standards to predetermine factors used to evaluate alternatives.

- For example, a company will receive $10,000 when they sell a machine in 10 years.

- 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

The first payment will be disbursed one year from the settlement date. The undiscounted cash value of the settlement is $500,000 (5 payments x $100,000). However, because of the time value of money concept, the settlement is not valued at $500,000 since it is not fully payable now.

Therefore, it will be a good decision to pick this project that can add value to the business. Using the more common capital budgeting decision tools, let us calculate and see which project should be selected over the other. NPV is the sum of the present values of all the expected cash flows in case a project is undertaken. The primary objective of capital budgeting is to maximize shareholder wealth.

Discounted Cash Flow Analysis

It’s the simplest form of capital budgeting but also the least accurate. It’s widely used as it can easily provide decision-makers with a quick understanding of the real value of a project or investment. Let’s take a look at the term investment appraisal in greater detail. It is a way of measuring potential risks against the expected return on investment. Decision-makers use this to analyze investments of equipment to expansions and takeovers.

The cash flows are discounted since present value assumes that a particular amount of money today is worth more than the same amount in the future, due to inflation. The IRR method is also problematic when the discount rate of a project is not known. If a discount rate is not known, there is no benchmark to compare the project return against. In cases like this, the NPV method is superior as projects with a positive NPV are considered financially worthwhile. Salvage value is the residual value of an investment or asset at the end of its useful life.

In this step we will look at all of the projects, and determine whether they meet the company’s basic guidelines for consideration. Our company, may for example, require a 20% rate of return on a new investment before it will even be considered as an option. Once we screen all of the potential options, if any meet this guideline, we can move on the the preference decision. when can you file your taxes this year A preference decision involves choosing among multiple capital investment options based on their potential returns and alignment with strategic goals. It typically follows an initial screening process where non-viable projects are eliminated. The profitability index (PI) is calculated by dividing the present value of future cash flows by the initial investment.