This list is often called the accounts payable trial balance (or a schedule of accounts payable). Follow New York Times Books on Facebook and Twitter (@nytimesbooks), sign up for our newsletter or our literary calendar. The Times has expanded to several other publications, including The New York Times Magazine, The New York Times International Edition, and The New York Times Book Review. In addition, the paper has produced several television series, podcasts — including The Daily — and games through The New York Times Games.

MS. RACHEL AND THE SPECIAL SURPRISE

Usually, debits have a left alignment in the entry field while credits are indented or aligned with the right side of the line. This is an easy method for quickly identifying which transactions are deposits, and which ones are withdrawals. The correspondence accounts that should be recorded included accounts payable, inventories, expenses, and other related accounts. Entities might purchases goods or services and make the payments immediately to suppliers by cash. If you make a mistake in your purchases journal, it is important to correct it as soon as possible. You may also want to consider using a software program or online tool to help you track your purchases.

Content

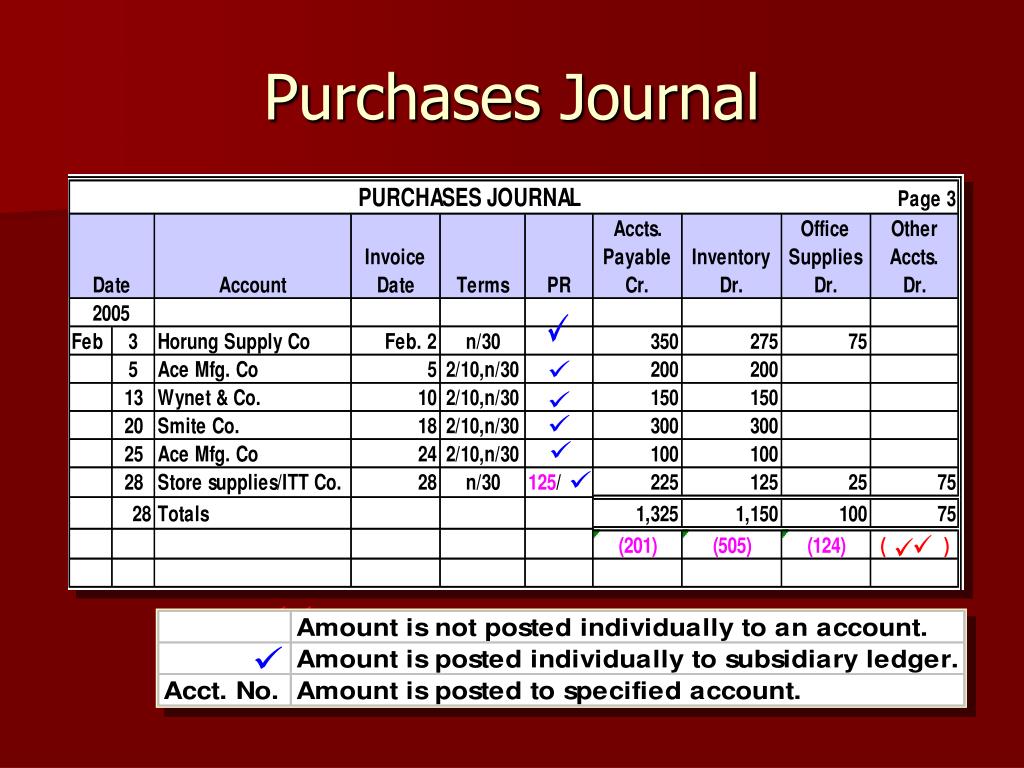

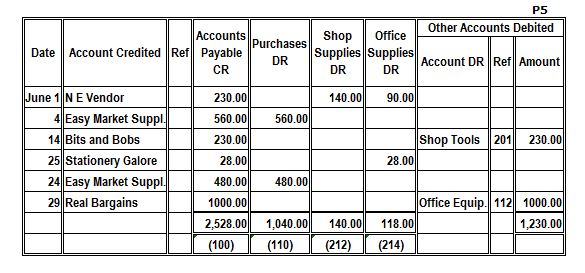

A typical purchases journal has several columns to record the date, vendor account, invoice date, credit terms, accounts payable balance, and other account balances. All of these columns use source documents that were acquired throughout the voucher system. The purchase order is used to record the terms of the vendor’s credit. A purchases journal is a journal category devoted to business purchases. Businesses often have hundreds of purchases that range from office supplies to services. In most cases a purchase journal will not have many credits since you use it to track spending.

Best Sellers Methodology

- Purchase journals also help in Creditors management, tracking returned goods status, credit notes, and updated ledger balances of Suppliers, all of which are required for a business to be successful and up to date.

- This decreases the cash balance, indicating money paid out for the purchase.

- The journal entry shows that the company received computer equipment worth $1,200.

Purchase journals are special journals used by an organization to keep track of all the credit purchases. While credit transactions are recorded in the Purchase book, cash purchases are entered in a general journal. It is worth mentioning that only the credit purchase of goods is recorded in such journals, and any capital expenditure is excluded. Since the purchases journal only records credit transactions, none of the cash transactions made during the period are posted in it. Instead, all cash inventory and supply purchases are recorded in the cash disbursements journal.

Explanation for Credit Purchase

For example, credit purchases should be an increase in credit as it is the liabilities. If those purchases are for inventories, then inventories accounts should be debited. The main information in the purchase journal includes the name of the entity, accounting period, date, suppliers’ accounts, invoices date, and payment terms. A purchase journal is a special journal that uses to record all of the transactions related to purchases on credit. In the landmark decision New York Times Co. v. United States (1971), the Supreme Court ruled that the First Amendment guaranteed the right to publish the Pentagon Papers. In the 1980s, the Times began a two-decade progression to digital technology and launched nytimes.com in 1996.

Journal Entry

This may be daily, weekly, or monthly, depending on the type of business you run and the products and services you offer. Therefore, the amount column represents a credit to accounts payable and a debit to purchases at the full invoice price. The accurate recording of inventory purchases is fundamental to effective inventory management and financial reporting. If the purchase is on credit, credit the Accounts Payable account to increase the company’s liabilities, indicating that the company has an obligation to pay the supplier in the future.

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. This increases liabilities, indicating an obligation to pay the supplier in the future. Notice that the total amount debited is equal to the total amount credited.

Besides these specific journals, accounting teams also use a general journal. A general journal tracks transactions that do not fall into one of the four categories. An accounting team may use other specialty journals to track certain types of transactions.

Optional additions to this basic set of information are the payment due date and authorizing purchase order number. The purchase book records all the credit purchases in one place, and details of Suppliers, invoice number, currency, quantity, and other details are mentioned there. The balances for these Suppliers from the Purchase book are transferred invoice for a freelance designer to individual ledgers, and a total of expense heads is debited to an expense account. This is one of the basics books in the bookkeeping process, which is essential in preparing ledger balances, trial balance, and final accounts. In this case, the balances of $500, $1,000, and $2,000 will be posted to individual ledgers of Nike, Adidas, and PUMA Ltd.

For example, you receive a refund for returning a purchase or adjusting an expense amount. The purchases journal is mainly used to record merchandise and inventory purchases on credit. If these are the only transactions recorded in the purchases journal, then the journal is similar to the one shown in the example below.